Business Insurance in and around McDonough

One of McDonough’s top choices for small business insurance.

Helping insure small businesses since 1935

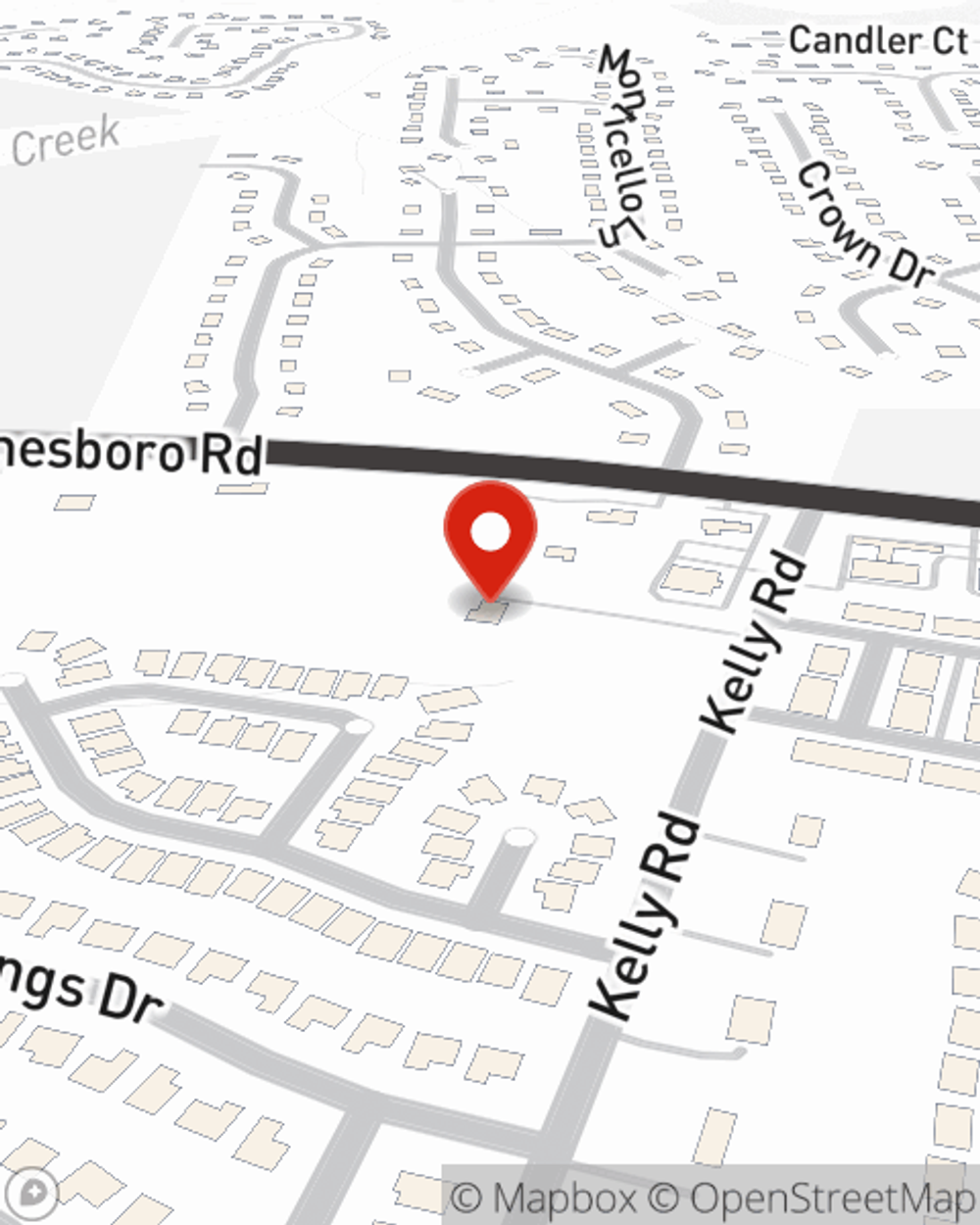

- McDonough

- Atlanta

- Stockbridge

- Hampton

- Brookhaven

- Locust Grove

- Griffin

- Covington

- Conyers

- Barnesville

- Jackson Lake

- Morrow

Your Search For Outstanding Small Business Insurance Ends Now.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Ann Sullivan. Ann Sullivan can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

One of McDonough’s top choices for small business insurance.

Helping insure small businesses since 1935

Protect Your Future With State Farm

For your small business, whether it's an arts and crafts store, a beauty salon, a pizza parlor, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, accounts receivable, and computers.

Visit the terrific team at agent Ann Sullivan's office to explore the options that may be right for you and your small business.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Ann Sullivan

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.